by Nomad

Trump wants you to think he is a friend to small business owners. But the truth is that Trump is Trump, and his critics suspect he's still trying to scam small business owners.

Trump wants you to think he is a friend to small business owners. But the truth is that Trump is Trump, and his critics suspect he's still trying to scam small business owners.

Perceptions and Facts

In a 2013 study, Pew Research Center found that your personal view of the economic situation has very much to do with your party affiliation.

When it comes to the basic question of whether the economic system is more secure today, Democrats perceive that things are getting better and Republicans, on the other hand, see little progress.

The objective measures of economic recovery tend to take a back seat to our political prejudices. A behavioral economist will tell you that, when it comes to the economy, perceptions count almost as much as facts.

In the United States, there are 28 million small businesses. Since 1995, small businesses have generated 64 percent of new jobs. Suffice to say, promoting and developing small businesses is a big part of any economic recovery.

Therefore, the perceptions of small business owners are an important indicator of the progress of the economic growth.

The Pessimism of Small Business Owners

A recent report from the National Federation of Independent Business (NFIB), an association representing 325,000 small and independent businesses owners suggests that small business owners do not share much enthusiasm about the economic improvement.

Said NFIB Chief Economist Bill Dunkelberg

"[T]he NFIB survey showed no signs of strength in the small business sector. Uncertainty seems to be the major enemy of economic progress and the political climate is a major contributor to the high levels of uncertainty that we’ve seen. The current economic environment is not a good one for strong or sustained growth."

Its report suggests that small business owners are not very optimistic about the economy and, the expectation of worse business conditions has led owners to be less eager to expand and in turn, less likely to hire new workers.

Its report suggests that small business owners are not very optimistic about the economy and, the expectation of worse business conditions has led owners to be less eager to expand and in turn, less likely to hire new workers.

In this particular group, signs of optimism yet to bloom after the crash of 2008. As the graph shows, this lack of confidence in the economy continued for two years reaching its lowest point at the end of the recession in 2010.

If small business owners are depressed, it's not from the Obama administration's lack of diligence. The president has cut taxes for small businesses 18 times. In January 2012, he raised the position of Small Business Administration (SBA) administrator to Cabinet-level. Under President Obama, SBA has improved opportunities for small businesses to start and grow.

Due to the sequestration slugfest, a total of $92 million, or 5 percent of the annual budget for SBA was slashed.

Nevertheless, over the last eight years, SBA has supported over $130 billion in lending to more than 225,000 businesses and nearly $380 billion in federal contracts went to small business over the past five years.

Trump: The Friend of Small Business?

There's a little more to the story and the truth is much more interesting. It has to do with the manipulating public perception and then politically exploiting those misperceptions.

A few days ago Market Watch reported, in a piece by Paul Brandus, that the Republican nominee has his own plan to help small business owners. His proposed tax plan would set a 15% limit on business taxes.

A few days ago Market Watch reported, in a piece by Paul Brandus, that the Republican nominee has his own plan to help small business owners. His proposed tax plan would set a 15% limit on business taxes.

Without much in the way of elaboration, he added:

“Small businesses will benefit the most from this plan.”

The NFIB promptly endorsed Trump and his plan, declaring:

“Mr. Trump’s plan would eliminate the disparity between the way large corporations and small businesses are treated under the code and all businesses would be taxed at a substantially lower rate.”

The left-leaning watchdog organization, the Center for Media and Democracy (CMD) might have a good explanation why the NFIB would be so supportive of the Republican nominee.

It really is a mystery too.

After all, Trump's career as a property developer is pockmarked with stories of Trump ripping off small businesses.

Trump has been involved In more than 3,500 lawsuits over the past three decades — and a large number of those involve ordinary Americans... who say Trump or his companies have refused to pay them. At least 60 lawsuits, along with hundreds of liens, judgments, and other government filings .. document people who have accused Trump and his businesses of failing to pay them for their work.

Given that history, it's difficult to call Donald Trump a friend of small business. In his mogul-days, he worked up a sweat exploiting small businesses and today appears to feel little in the way of remorse.

So it seems peculiar- fishy, even- that NFIB should rush to endorse this man in particular.

People Behind the Perceptions

There's one easy explanation.

Despite the fact its members are not predominantly Republican, (33 percent identify as Republicans, 32 percent as Democrats, and 29 percent as Independent) critics have called NFIB a "conservative lobbying group with close ties to the Republican Party."

Despite the fact its members are not predominantly Republican, (33 percent identify as Republicans, 32 percent as Democrats, and 29 percent as Independent) critics have called NFIB a "conservative lobbying group with close ties to the Republican Party."

That hasn't stopped the NFIB staffers from telling the IRS that the group is a "non-partisan" service organization.

A study posted on a CMD's website, NFIBexposed.org, alleges that the NFIB has consistently lobbied on issues that favor large corporate interests rather than small-business interests.

Furthermore, according to the website, its "thoroughly partisan agenda"; and the millions it receives in secret contributions can be traced back to some powerful right-wing groups.

For example,NFIB accepted a $3.7 million gift in 2010, and a further $1.4 million in 2012, from Crossroads GPS, a group affiliated with Republican political operative Karl Rove that overwhelmingly endorses and financially supports Republican candidates.

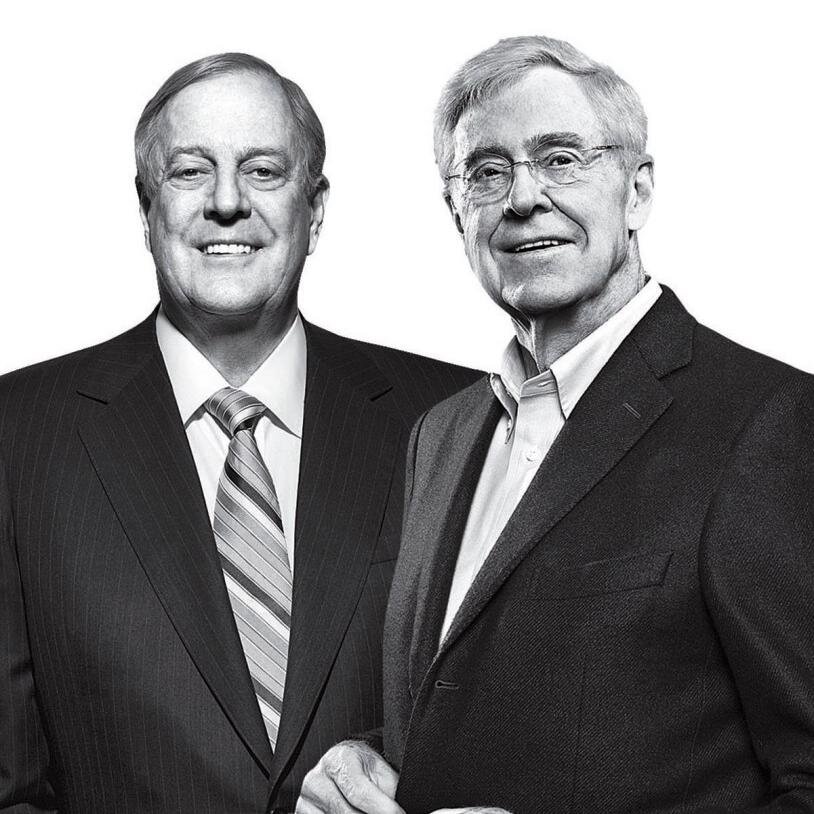

NFIB also received $1.5 million in 2012 from Freedom Partners, a behind-the-scenes organization that has been described as the "Koch brothers' secret bank," according to tax documents.

As CNN reported, NFIB "got more money [in 2012] from a group backed by billionaire industrialists Charles and David Koch than any other single source."

There's more evidence that NFIB isn't exactly what it seems to be.

Scientifically-conducted national surveys of small business owners show that most small business owners support key provisions of health care reform, favor ending special tax breaks for the wealthy, support protecting clean air in local communities, and believe in promoting workplace safety -- all issues NFIB has lobbied against.

Still, the organization portrays itself a lobby "for the interests of small businesses." (To make matters worse, mainstream media, including The Washington Post The New York Times, have uncritically described the organization in the same way.)

Of course, the support of Trump's small business tax plan would seem to disprove that assumption of corporate intrigue.

The Other Shoe Drops

A few days after Trump announced his small business tax proposal, the other shoe dropped. Reportedly, Trump ever so quietly revised his plan, effectively eliminating the benefits small business owners would have received.

He still backs a 15% rate on corporate income. But missing in the new plan: a 15% rate for so-called “pass-through income” that’s usually generated by limited liability companies or sole proprietorships—in other words, small businesses. In practical terms, that means the only businesses that would qualify for the 15% rate are large corporations.

The news quickly spread. On Thursday, Forbes also pointed out that the special 15 percent rate for pass-through income — the sort of income generated by a partnership, a limited liability company, sole proprietorship, or S Corporation — conspicuously absent from the revised agenda.

According to the news, the leaders of the NFIB claimed to be "alarmed" by the flip-flop. On behalf of their membership, the Trump campaign was asked to explain. Trump's people reportedly assured the NFIB that the pass-through provision in the original tax plan still applied.

However, the Tax Foundation, an independent Washington, D.C.-based think tank, analyzed the Trump proposal came to the conclusion that the “pass-through income” provision was no longer "clearly specified in current plan documentation.”

Where the Truth Lies

As with so many tales of Trump, somebody clearly isn't telling the truth. Trump’s finance chairman, and former Goldman Sachs banker, Steven Mnuchin suddenly had to deal with accusations that Trump was backpedaling on pass-through. By the end of the week, after a lot of economic "clarification, the issue remained as clear as mud.

Writing for Forbes, Robb Mandelbaum made this observation:

The vast majority of small businesses with pass-through income already pay a tax rate at or below 15 percent. And as I reported in March, the Trump campaign never made clear whether 15 percent would have been a flat rate or a top rate. If he intended it to be a flat rate, those businesses paying less than 15 percent now would of course face a tax increase under the original version of Trump’s plan.

What a mess. Was Trump caught in a lie again or was it simply incompetent policy?

Who knows.

Whatever the truth is, small business owners who might have thought that Donald Trump had a plan or that Trump gave a hoot about their problems may want to have another round of thinking.

From the looks of it, his tax plan is pure Trump, still ripping off the small business owners just like he did when he played the part of the successful real estate developer.

Why should he have changed? It's always worked perfectly in the past.